Your Path to Passive Real Estate Ownership

Investing with Foundation 2 Freedom is Simple

🔎

Explore Investment Opportunities

Explore our current and upcoming apartment investment opportunities. Each offering comes with comprehensive projections, property details, and financial analyses.

✅

Evaluate & Commit

Carefully examine the investment information. Our team is here to assist with any questions. When you’re ready, proceed with your investment commitment.

💰

Finance Your Investment

Confidently and securely transfer your investment capital.

🧾

Passive Ownership

We manage every step of property acquisition, operations, and tenant communications, while you receive consistent distributions from rental income.

📶

Monitor Your Investment Progress

Log in to your personalized investor dashboard to view real-time updates, financial reports, and essential documents.

🔁

Generate Returns

Enjoy consistent cash flow and potential capital gains upon the property's sale.

Who Can Invest?

Building wealth through real estate doesn’t require a millionaire’s portfolio. Whether you’re an experienced investor or new to the market, our platform is designed for:

Busy professionals looking to diversify

First-time investors ready to build passive income

Retirees seeking stable cash flow

Diaspora Nigerians looking for credible investment back home

Entrepreneurs who want their money working smarter, not harder

If you’re ready to grow your portfolio and partner with experts—you belong here.

Why Invest With Us:

Passive Income: Let your money work for you without the headaches of traditional landlord duties.

Diversification: Add a tangible asset to your portfolio.

Professional Management: Our experienced team handles all operational aspects.

Transparency: Regular reporting and open communication.

Potential for Higher Returns: Through strategic use of debt equity.

Risk Mitigation:

We employ conservative underwriting, thorough due diligence, and diversified portfolios

to minimize risk while maximizing potential returns.

What Client Say

Here’s what our investors are saying about their

experience with us:

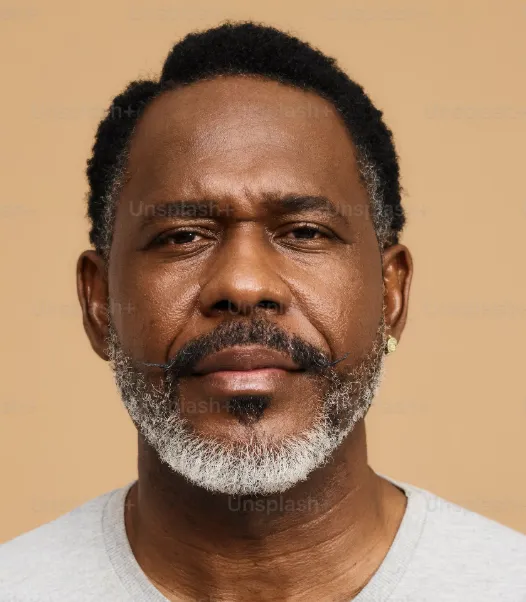

Ezekiel Floyd

The tailored guidance and professional insight I received led to financial growth beyond my expectations.

Collins Zheng

Their strategic investment management has provided me with peace of mind and steady, reliable returns.

Susan Albrighton

Partnering with their team has completely reshaped my financial perspective—they genuinely understand my goals and priorities.

Frequently Asked Questions

What are the most frequent questions asked about investing in

apartment buildings by accredited investors.

Is investing in apartment buildings a good idea?

Yes, apartment buildings offer reliable income, long-term value growth, and valuable tax advantages. Unlike single-family properties, they produce revenue from several units at once, helping to minimize investment risk

What Are the Various Methods for Investing in Apartment Properties?

Investors can purchase apartment buildings directly, participate in crowdfunding opportunities, invest through REITs, or collaborate with partners to co-own properties.

What Are the Requirements to Qualify as an Accredited Investor for Apartment Building Investments?

To qualify as an accredited investor, individuals must meet SEC-defined income or net worth thresholds—typically earning $200,000 per year ($300,000 jointly) or possessing a net worth over $1 million, not including their primary residence.

What Types of Financing Are Available for Investing in Apartment Buildings??

Investors can finance apartment purchases through conventional bank loans, government-sponsored programs, private lending sources, or by participating in syndication deals.

What Potential Risks Should Investors Be Aware of When Investing in Apartment Buildings?

Risks may include shifts in the market, tenant turnover, management difficulties, and unforeseen repair expenses. However, thorough due diligence and effective oversight can help reduce these risks.

What Factors Contribute to the Increase in Value of Apartment Buildings?

An apartment building’s value is closely linked to its rental income. Investors can boost its worth by enhancing amenities, increasing rent levels, and keeping occupancy rates high.

What Tax Advantages Do Apartment Building Investments Offer?

Investors can take advantage of tax benefits such as depreciation write-offs, deductions on mortgage interest, and the ability to defer capital gains taxes through 1031 exchanges.

Your Reliable Partner in Building Wealth and Achieving Investment Success — Dedicated to Securing Your Financial Future.

Quick Links

Company Info

(510) 688-7749

4011 Moller Ranch Way , Antioch California 94509